Blog Post

Share Publication

On November 18, 2025, Max represented Leitmotiv at the Summit on European Digital Sovereignty in Berlin, addressing strategies for fairer digital markets, reduced technological dependencies, and protection of Europe's strategic assets.

There, he highlighted Europe's existing infrastructure strengths and presented French & German government, industry, academia, and civil society with targeted policy interventions and a vision for an open European marketplace for digital services.

Since Europe already has world-class digital infrastructure that produces resources at a fraction of the cost charged by major cloud providers, the goal should not be building new infrastructure.

The real challenge is to create an open market that enables fair and effective competition by all market actors, allowing Europe's existing infrastructure to benefit consumers, businesses, and the broader digital economy.

Read the shortened version of the presentation below to learn more about Leitmotiv's current work.

Cloud markets: Single-brand supermarkets for digital resources

Digital resources power the storage, processing, and transport of data. They're produced by physical infrastructure: fiber cables and networks, data centers, servers, and chips.

Think of the cloud market as a supermarket where digital resources (compute, storage, and network capacity) are the raw ingredients you can buy. But there's a crucial difference.

In a regular supermarket, you find products from multiple farmers and companies. In a cloud supermarket, you can only buy digital resources from a single producer, and every other product that is derived from the digital resources (platform and cloud services) is also manufactured by the house brand.

Since January 2025, many have called for building European infrastructure – including the European Commission (based on The Draghi report on EU competitiveness), ECB President Christine Lagarde, and the EIB with its increased investments in energy infrastructure projects. This surprised us. Europe already owns world-class digital infrastructure, built and operated by European companies – some of which attended the Summit on European Digital Sovereignty. These companies produce digital resources at one-tenth the cost of what we pay in non-European cloud markets.

Why European providers aren't winning despite lower costs

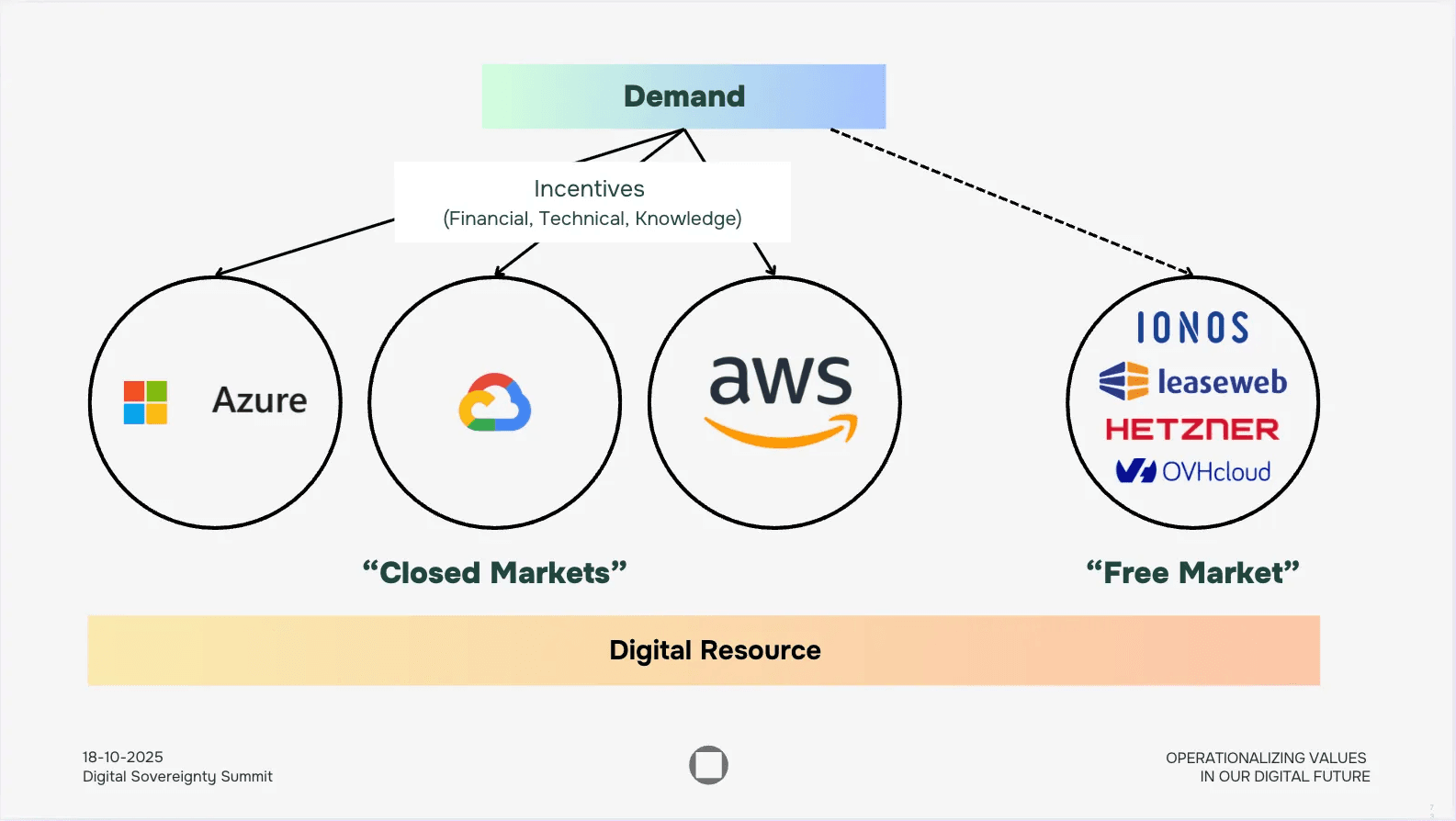

European infrastructure companies are locked out of demand captured within closed cloud markets. Demand flows into these markets because providers use bundling strategies and financial incentives to capture the demand.

These practices have continuously shifted demand away from European providers, which often have been active in the market for much longer than the large cloud providers. While some European businesses resist competing on these terms, shying away from embracing bundling practices and offering incentives, the current market dynamics makes it increasingly difficult to compete and capture demand.

Figure 1. Demand for digital services flows into three “closed markets” run by the big cloud providers (Azure, Google Cloud, AWS), attracted by financial, technical, and knowledge incentives. Meanwhile, competitive European providers (IONOS, Leaseweb, Hetzner, OVHcloud) sit in a separate “free market,” even though they supply the same underlying digital resource – compute, storage, and network capacity.

To illustrate this, consider the example of a startup building a digital service. If its investors are Google Cloud partners, they can offer the startup €300,000 in free digital resources within Google's closed market. This saves scarce capital for both parties and creates a strong incentive to build "on Google" rather than choose European alternatives, which do not offer equal incentives.

There's another layer to this challenge. In today's digital economy, most digital resources power digital services – the products that companies, governments, and consumers actually purchase — the market for ‘raw’ digital resources therefore is shrinking. Using our supermarket analogy: most people buy processed food rather than raw ingredients, either directly or through intermediaries, thus further strengthening the market position of the large cloud providers that offer bundles of resources & services.

Best services won't get worse by running on our infrastructure; they'll get better

When the services that people truly rely on receive exclusive incentives to get their resources from the big three cloud markets, we face a structural problem.

Unfortunately, Europe cannot realistically recreate all the digital services it depends on. Consumers prioritize quality and functionality over regional origin – they want the best service available, regardless of where it comes from. And at the moment the best services are often tied to the closed cloud markets.

What we can achieve, however, is running the best services on European infrastructure. Let’s explore how to do that using the regulatory power of Europe and an approach that we have used before: market liberalization.

How Europe can use its infrastructure advantage

The path forward mirrors Europe's successful energy market reforms: open the cloud market to genuine competition. This would enable European infrastructure providers to compete for the demand currently trapped in closed markets.

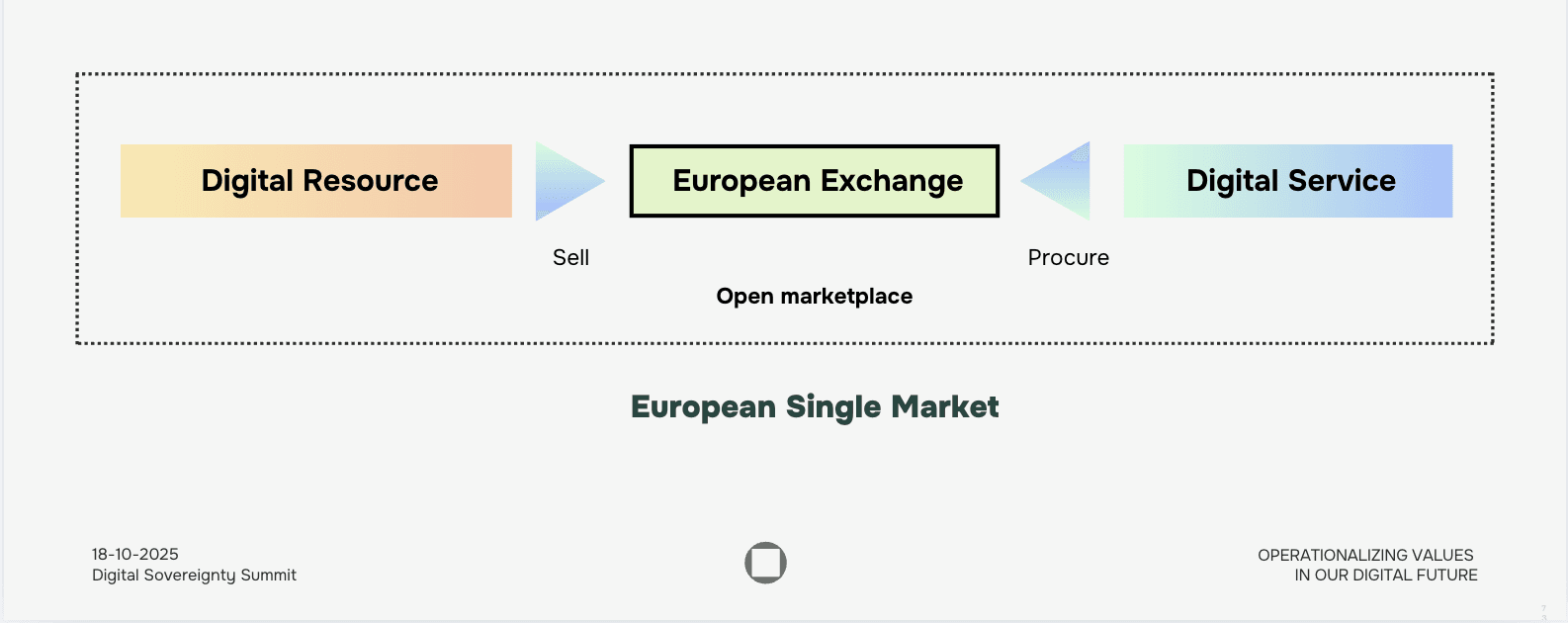

Figure 2. A European Exchange would allow providers to sell digital resources and digital services to be procured through a shared, open European Single Market with competition, lower commodity costs, better services, and more opportunities for resource-intensive applications.

An open cloud market creates real competition, which drives down costs, improves service quality, and unlocks new possibilities for resource-intensive applications like AI.

The model is straightforward: any digital service operating in the European Single Market must source its digital resources from an open marketplace. Whether that is a central European market or national markets is up for discussion. In these open markets, providers are competing on price and quality criteria such as environmental impact and security standards.

The technology exists; regulation is the missing piece

Closed markets already offer on-demand resources, spot instances, and futures on capacity. They operate just like the energy or other commodity markets, the only difference is that not everyone can trade on them.

Europe has already funded the necessary research and technology development through IPCEI and Horizon projects. The challenge is not technical capability. The task is to achieve market adoption under current conditions.

Creating a level playing field requires Europe to use its regulatory authority decisively. An open, European cloud market, would create competition in digital resource production, giving our digital economy the competitive infrastructure it needs to thrive globally.

Such a market can of course be jump-started by directing public IT & digital spending through it first. However, it is critical to bring private markets along, and either target existing incentives through tools like the Digital Markets Act or offer matching incentives, financed from the transaction fee’s collected through the open market.

The path forward: Open markets for digital resources

Europe's digital infrastructure is already world-class and cost-competitive, but it remains underutilized due to closed cloud markets that lock in demand through bundling and financial incentives. By opening these markets to genuine competition, we can enable European providers to compete fairly, reduce costs, improve service quality, and position Europe's digital economy for global competitiveness.

The full paper was originally written as a response to the upcoming EU AI & Cloud Development Act. It evaluates the assumptions underlying the Cloud and AI Development Act and outlines specific policy interventions needed to make this vision real.

Click here to read the complete version of our Response to the EU AI & Cloud Development Act.